Biden wrong to oppose Nippon Steel Deal

The state visit by Japan’s Prime Minister Fumio Kishida isn’t just about tea and photo ops. It’s a wake-up call for the Biden administration to get serious about bilateral economic relations with one of our closest allies and to stop threatening to derail the proposed deal between Nippon Steel and U.S. Steel.

The deal is a win-win for American workers and shareholders. U.S. Steel stock was floundering at about $39 per share before Nippon offered a whopping $55 per share – a 40% premium. The market roared its approval. This is a clear signal that Nippon – with its all-cash offer – sees immense potential in American steel, a sentiment the Biden administration seems shockingly blind to.

Joe Biden’s knee-jerk opposition to the deal sent U.S. Steel stock plummeting 15%. This is a real cost of government meddling. It throws uncertainty into the market and undermines investor confidence.

Nippon Steel’s commitment is clear: to grow U.S. Steel’s operations, protect American jobs, and counter the issues stemming from China’s state-subsidized exports. This acquisition is a strategic move to create a more competitive steel producer capable of meeting demand in the U.S. market and competing globally.

Unlike the rival bid from Cleveland Cliffs that would consolidate the domestic steel industry into one major player, it means two robust companies going forward making steel in American factories.

The benefits of this deal extend far beyond the balance sheets. For U.S. Steel, it means leveraging Nippon Steel’s advanced technologies to enhance production processes and maintain aging facilities, including blast furnaces. It’s an opportunity to produce high-grade steel products like electrical steel and automotive flat steel.

For the workers, this deal is a lifeline. It guarantees job security, with no layoffs or facility closures, and ensures that plants remain rooted in Pennsylvania. The iconic U.S. Steel name and Pittsburgh headquarters remain. The local communities see growth in the supplier base, contributing to a thriving regional economy. An enormous capital infusion is a win for domestic manufacturing.

Foreign investment isn’t some monster under the bed. It’s a powerful engine for growth. It creates jobs, injects capital, and brings cutting-edge technology to American shores.

Although U.S. affiliates of foreign multinational enterprises comprise less than 1% of U.S. companies, in 2021 these affiliates in America accounted for 13% of business spending on research and development, 17.3% of investment in plant and equipment, and 23.6% of total goods exports.

Japanese companies held $775 billion in direct investment in the United States on a historical-cost basis at the end of 2022 – the most of any country.

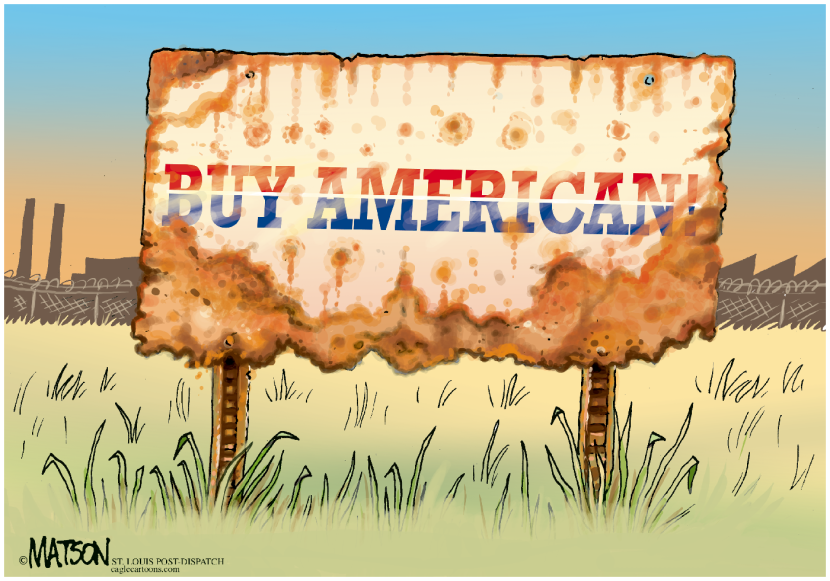

There is nothing new or risky in greenlighting this transaction; the dangerous move would be to block it, which would send a disastrous message: America is retreating from free trade and investment not just with rivals like China but with friends like Japan. This hurts American workers, stifles innovation, and surrenders our competitive edge.

Besides, as long as the U.S. is running persistent trade deficits, billions of dollars sent abroad must ultimately return to the country as investment flows. If large private-sector deals are taken off the table, those dollars will all flow into U.S. Treasury bonds, financing government spending.

Don’t be fooled by Cleveland Cliffs’ protectionist scaremongering effort to induce the federal government to deliver US Steel to them at a bargain basement price. $35 a share? Only half of it in cash? Chump change compared to Nippon’s $55. An insult to millions of Americans who are invested in US Steel through their retirement accounts, and that presents none of the upside for the industry of Nippon’s infusion of cash and technology.

This deal is about American jobs, shareholder returns, and the principle that the government has no business blocking investment by a private company based in one of our closest allies.

Let’s hope that – despite his recent public statements to the contrary – Biden comes to his senses and sends Kashida the right message: America, and its steel industry, are open for business.

–

Copyright 2024 Phil Kerpen, distributed by Cagle Cartoons newspaper syndicate.

Phil Kerpen is the president of American Commitment and the author of “Democracy Denied.” Kerpen can be reached at [email protected].